No one ever got fired for buying ... Nvidia

We need to talk about risk, FUD and other factors that influence decision making

This is the last of a short series of posts on Nvidia’s AI Accelerator ‘moat’. The other posts in the series, each of which explores the history of that moat or lessons from other longstanding technology moats, are:

This post is about how the importance of a product can reinforce the position of the market leader.

Picture the scene. You’re in the office of your CEO and the CFO has joined you too. There is an eery silence. The CEO, looks you in the eye and says:

CEO : We’re about to spend $200m on hardware. The success of this purchase is crucial for the future of the company. Are you really sure we should spend it with company X rather than company Y? All our competitors are going with Y. Are you certain this is the right decision? This will make or break your career.

You : Gulp!

This scene will have been played out thousands of times in corporate offices over the last 60 years. In the 1960s and 1970s the Y would have been IBM and the X might have been Sperry, Honeywell, Univac or ICL. The decision would have been about buying a piece of ‘big iron’, a mainframe.

There was the famous saying ‘No-one ever got fired for buying IBM’. It’s almost certainly not true. It’s probably true though that a lot more people got fired for buying something other than IBM.

Decades later, buying the big IBM machine probably looks like the right decision. IBM never was dislodged from its position as mainframe market leader, and still makes and improves the machines, when the others have given up the ghost.

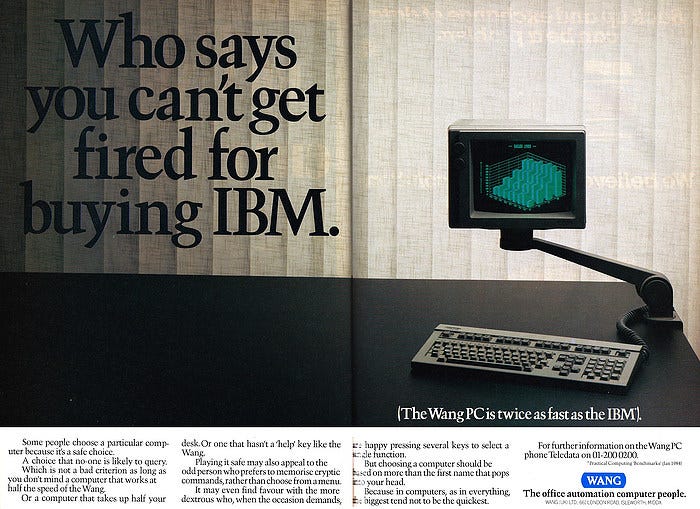

Wang tried to turn this around in adverts for PCs in the 1980s.

This was probably counterproductive, reminding people that they were much more likely to get fired for buying Wang, than for opting for Big Blue.

But it was worth a try, as taking a risk on buying a few Wang PCs was probably much less likely to be career limiting. Buying PCs from another firm was simply a less important decision than buying a mainframe. And the rise of the 100% IBM PC compatibles made it almost ‘risk free’.

And indeed, IBM did, quite quickly, lose its leadership of the PC market to PC compatibles, as firms took the risk of buying Compaq, Dell and other brands.

IBM’s PC market share fell from around 80% in 1982 to around 20% ten years later. In 2005, IBM sold its PC business to Lenovo.

So, let’s fast forward to 2023 and again firms are taking decisions on the purchase of hundreds of millions or billions of dollars of hardware. This time it's for ‘AI accelerators’.

And who is the ‘IBM’ this time. It’s Nvidia, of course. So what can we learn from the ‘No one ever got fired for buying … ‘ factor?

The rest of this edition is for paid subscribers. If you value The Chip Letter,then please consider becoming a paid subscriber. You’ll get additional weekly content, learn more and help keep this newsletter going!