The Arm Story Part 3 : Creating A Global Standard

Big name partnerships shape the next chapter of the Arm story

In Part 3 of the Arm1 Story, we will see how Arm made it from a precariously funded spin off from Acorn Computers to a viable and successful, but not yet world-beating, business. To my mind, this is the most intriguing part of the story. How a small team, with an interesting, but in some ways flawed, technology, could, with limited financial resources, build a business that could succeed against much better funded firms in a fast moving and highly competitive international market.

First, a brief recap. In Part 1, a small team led by Sophie Wilson and Steve Furber working at Acorn Computers designed the first version of the ARM Instruction Set Architecture and the first ARM CPU. In Part 2, Acorn built the Archimedes Computer using an ARM CPU and, having failed to sell it in volume, agreed to spin off ARM into a joint venture with Apple. The new company, Advanced RISC Machines, would supply CPUs for Acorn and to be used in Apple’s new Newton handheld. Robin Saxby was appointed as CEO and the new company had found a home in a converted barn just outside Cambridge in the UK.

Strategy

Advanced RISC Machines needed a strategy beyond being a supplier for Apple and Acorn. Work on one potential business model for the new company had started at Acorn even before Saxby had arrived. But the numbers didn’t add up. According to Steve Furber:

The business model was to license the design and get royalties and if you get royalties on a small part of a chip you get a fairly small income per chip, and you’ve have to sell very large numbers to get the books to balance. So none of my attempts to produce a business model … looked very promising …

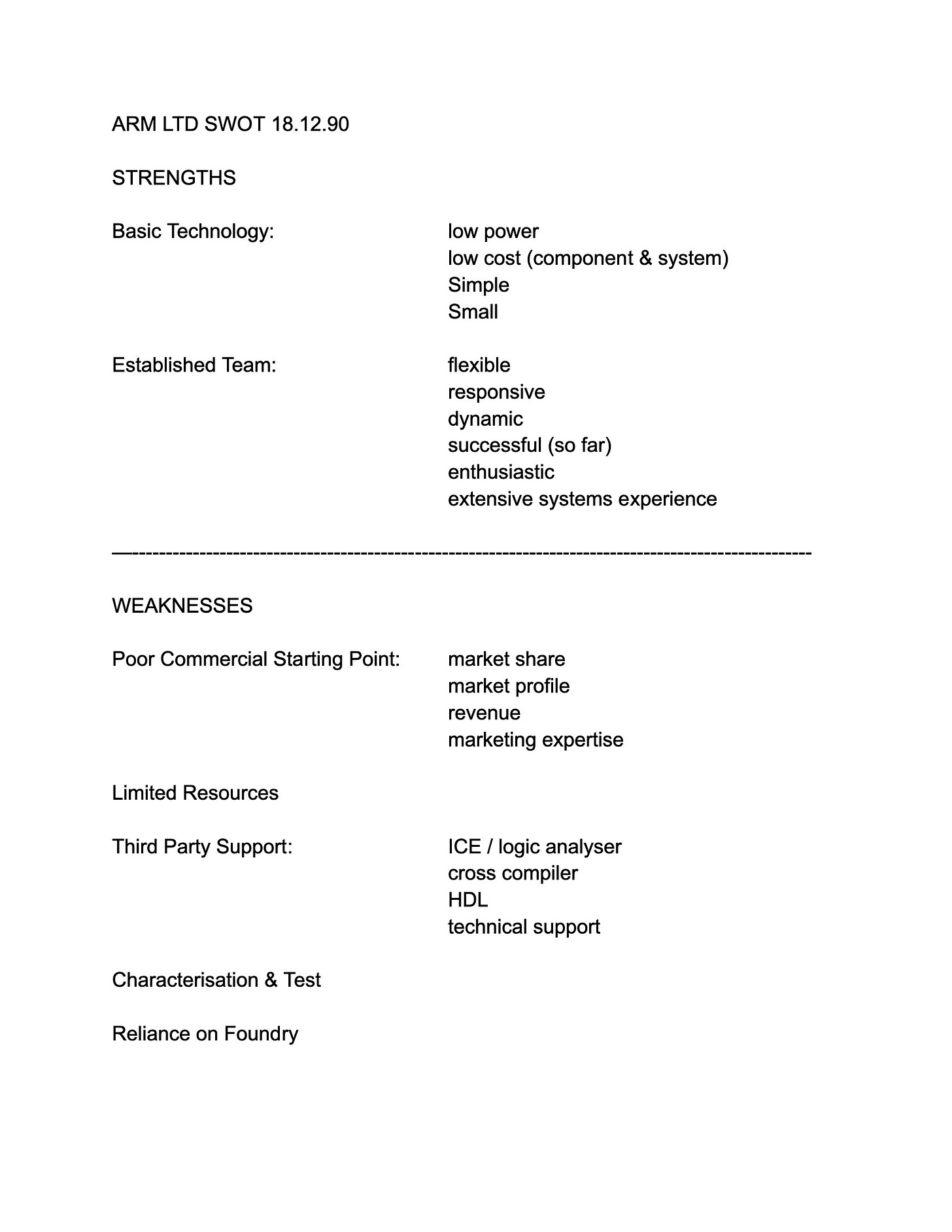

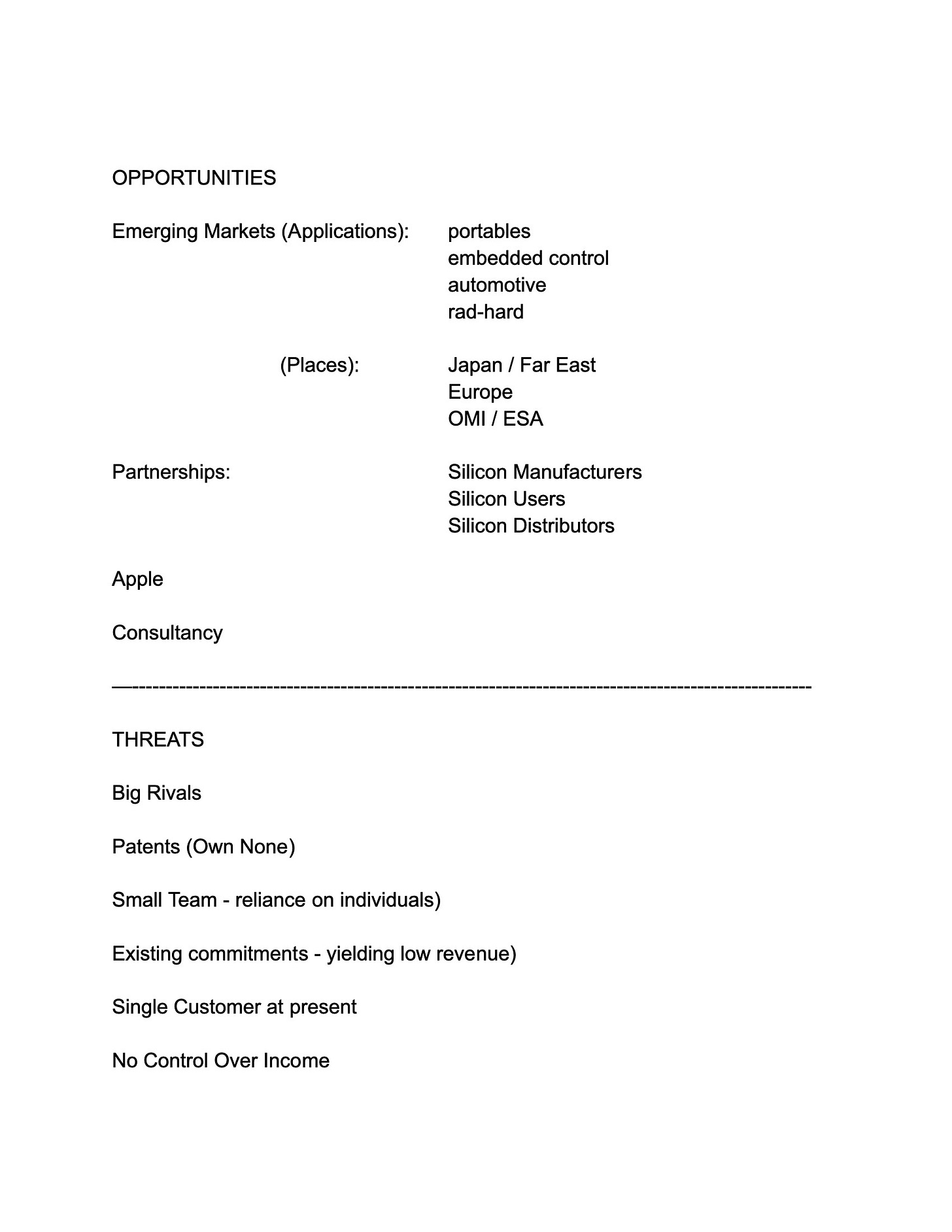

On 18 December 1990 the new Arm team got together to do a Strengths, Weaknesses, Opportunities and Threats (SWOT) analysis on their new venture. The threats looked daunting: ‘Big Rivals’ was top of the list. One key weakness was that the firm had no patents, as Acorn, despite the innovation in the early ARM CPUs, had failed to patent any of it. So Advanced RISC Machines would be an Intellectual Property (IP) company with very little protection for its IP. The biggest opportunities were in portables, embedded and automotive. The full SWOT is reproduced below:

Saxby realised that there were a few things to avoid. Intel’s x86 architecture was becoming dominant on the desktop, in business and more widely, so Arm would avoid competing head-to-head with Intel.

Equally, trying to compete in the workstation CPU market wasn’t a good idea either. Competition was intense from MIPS, SPARC, Motorola and others. Acorn had already tried and largely failed to sell ARM-based workstations using its version of Unix.

This meant selling into the portable and embedded markets. This brought its own issues, though. Embedded customers weren’t convinced that they needed the power of RISC processors. Saxby recalls the response that “You know, RISC processors, they're for workstations." There was also the challenge of how Arm would develop products that were suitable for the embedded market when almost all its resources were devoted to building higher-performance designs for Apple and Acorn.

Finally, the firm wouldn’t sell its own chips to end users. VLSI had tried to sell microprocessors using the early ARM designs, but without much success. Saxby was emphatic that “We should make chips over my dead body”.

Instead, following the strategy originally developed at Acorn, Arm would license its microprocessor core designs to other semiconductor manufacturers. They would pay a small fee to Arm for each microprocessor core shipped to customers.

This might be a winning proposition for other firms. They could get access to Arm’s technology at a lower cost than developing something comparable themselves. For many firms, the microprocessor core design wasn’t a competitive advantage for the firm and using Arm’s technology would free resources to focus on aspects of their designs where they did have superior technology.

As the number of licensees grew, then the advantages of using an architecture that was common across the industry would grow even larger. Firms would be able to use a growing range of tools and software for the architecture.

Other key aspects of the strategy included: Arm designs would be open for all to license and the company would be independent of individual semiconductor companies and their customers; no modifications would be allowed to the cores (“an ARM is an ARM”); firms who licensed Arm designs were described as ‘partners’ and the emphasis was on building long term relationships with them.

As Steve Furber had discovered, though, the licensing model had a problem. There was a significant delay (a minimum of 3–4 years) between Arm creating a new core and firms shipping enough of the design so that the royalties would make a meaningful contribution to Arm’s revenues. This would mean that it would be a long time before Arm would recover the development costs of a new core. How would Arm fund these up-front costs and keep the business running whilst waiting for the licensing revenues to roll in?

So an extra element was added to the financial model. Firms licensing an ARM core design would also pay an up-front fee to gain access and start using it. With this additional ‘up-front’ cashflow, the business model might just work.

Creating A Global Standard

It’s worth pausing at this point to consider just how fragile the financial and operational position of Advanced RISC Machines was in its earliest years.

It started with just £1.5m (roughly $2.5m) in the bank. Using this funding and with royalty income from Acorn, they would have to deliver new products for Apple and for Acorn and to develop brand-new sources of income from other customers.

One area where Arm’s fragile finances influenced the development of the company was in how the company filled senior non-technical positions. Saxby simply couldn’t afford to go out and recruit experienced industry figures to fill roles such as head of sales or head of marketing.

Instead, judging that members of his existing team would grow into their jobs, he gave these key roles to engineers who had come across from Acorn. Jamie Urquhart, who had previously led the silicon design group, became head of Sales. Mike Muller became head of Marketing. With some limited exceptions, if something needed doing, then the twelve engineers or Saxby would have to do it themselves.

Some of the team have talked about this time as being brutal in its demands on the founders and the early recruits. This period also helped to build what would become the Arm culture: one that placed enormous value on teamwork and on getting things done.

One of Saxby’s most ingenious early decisions was to create a two tier board structure. Advanced RISC Machines Holdings limited would be the company that would be owned by Acorn, Apple and VLSI. This company in turn would own Advanced RISC Machines Limited, where the directors would be the key employees and where operational issues would be debated. With this separation, Saxby kept operational decisions from shareholders and shielded his team from answering directly to the interests of shareholders.

Another key aspect of the Arm culture emerged early on. Saxby realised that if it was to be successful, then Arm would need to be a global company. In the early years of Arm, he made two intercontinental flights every month, jetting between the UK, US, Japan, and Korea.

The ambition went beyond being a global company. It extended to becoming a ‘global standard’. This must have sounded ludicrously ambitious for a tiny company with few customers based in the UK, thousands of miles away from Silicon Valley. In reality though it was a necessity, If Arm was to reach the scale needed to be viable.

ARMs to Apple and Acorn

First of all though, the Arm team had to deliver designs to its two founding shareholders.

The priority for Acorn was a floating-point coprocessor, the FPA10. In the end, Acorn’s computer business was struggling so much that only five hundred coprocessors shipped, a remarkably poor investment given that Arm needed to devote almost half of its engineering resources to the project. The effort wouldn’t be entirely wasted, as Arm would re-use this floating-point capability in its later core designs.

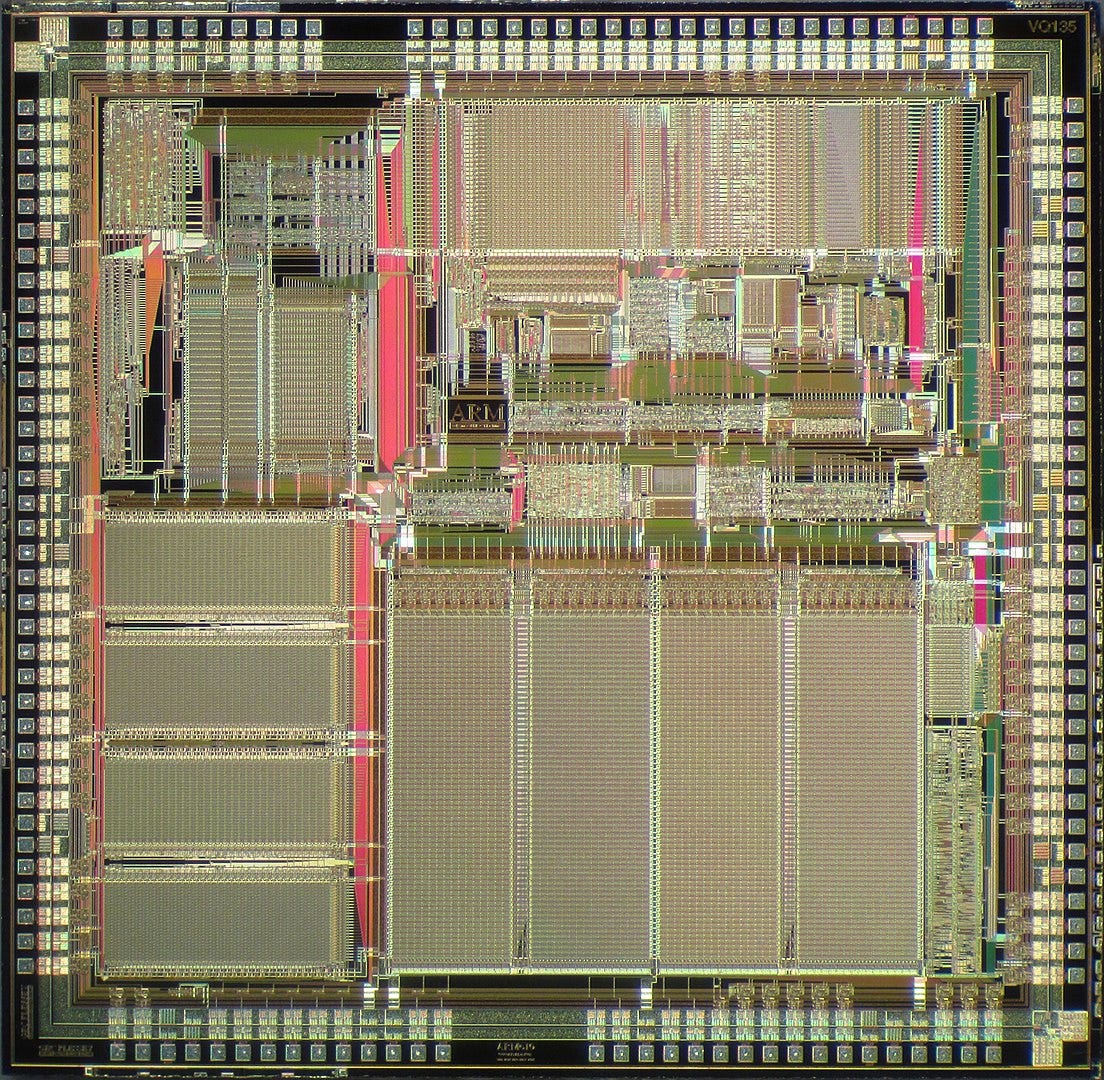

For Apple, there was the ARM 610, which would include a new ARM6 core, a memory management unit and 4 KB of cache and would be made by GEC-Plessey in the UK. The new ARM6 architecture also increased the size of addresses from 26 bits to 32 bits. The previous version of the architecture was ARM3 but Apple’s Larry Tesler, now on Arm’s Board, suggested that they jump ahead of Intel’s 80486 and Motorola’s 68040 designs.

The first samples of the ARM 610 were delivered to Apple in October 1991, just 11 months after the ARM team had started work on the design.

An ARM6 core used 33,494 transistors, compared to around 25,000 on the ARM1 and the 80486 which had around 1.2 million, and had a clock speed of up to 33 MHz.

Although it was a complete System-on-Chip design that was built for Apple, perhaps more importantly, as part of this work the team has been able to develop a CPU core that could be licensed separately. It would be the, still small and cheap, ARM6 core that would provide the starting point for sales into the embedded market.

Thumb

As 1991 progressed, Saxby energetically worked through his extensive contact list looking for potential licensees.

If the business model was to work, then the company needed new licensees. At the end of 1991, GEC-Plessey agreed in principle and then formally in mid-1992.

Meanwhile, the Arm team worked to develop the ARM architecture and the next iteration was ARM7, which would offer a significant speed increase over ARM6. With ARM7, the team could start to build in features that would support Arm’s proposition in the embedded market. These included important features for the embedded market, such as JTAG debugging and an In-Circuit-Emulator.

It would be almost a year before the next firm signed up. Sharp had been involved in Apple’s work on the Newton and was interested in Arm’s designs. It would be the interest of a large customer, in this case Nintendo, who would bring Sharp on board. Nintendo wanted to use an Arm design in their Game Boy Advance handheld gaming console. Sharp signed on as the third Arm licensee in March 1993.

Something was missing though if the architecture was to make in into Nintendo’s designs. Arm’s selling points were performance per watt and performance per dollar, and on these metrics it could win against any competition.

But there was one other metric that mattered in the markets that the company was targeting. To keep power consumption and costs down, these devices had limited memory resources.

Sophie Wilson’s instruction set had been designed for desktop computers and for the increasing amounts of memory that desktop computers had available. With plentiful memory bandwidth available to deliver instructions to the CPU, it made little attempt to reduce the size of ARM ISA code. All instructions were 32-bits long. Often some bits in each instruction weren’t really needed. For example, 4 bits of most instructions were devoted to conditional execution, which was unnecessary for most instructions.

As a result, ARM code was appreciably larger than comparable code for an 8-bit or 16-bit competitor. The extra storage required for this larger code size could add appreciably to the cost of the design. So for ARM to be fully competitive, they needed to find a way to reduce code size.

The issue was particularly acute for Nintendo as code for their portable games was distributed on cartridges. A bigger cartridge for a game would be a significant additional cost for each game sold.

The solution came from one of Arm’s earliest recruits. When studying in New Zealand, Dave Jaggar had been intrigued by the new Acorn RISC Machine. So much so that he wrote his Master’s thesis on the design, including identifying potential issues with the architecture.

Code size remained the pressing issue for the Arm team. Jaggar was recruited to the Arm team and set about developing a solution. A new truncated version of the ISA was devised that represented a subset of the existing 32-bit ISA. Frequently used instructions were squeezed into a 16-bit instruction length.

The new ISA was called ’Thumb’ as Jagger described it as ‘the useful bit on the end of your ARM’.

The CPU would switch to Thumb mode using a new instruction and could then switch out of it again at any point. When in Thumb mode, the CPU would translate the 16-bit instructions into their 32-bit counterparts ‘on the fly’. The overhead of doing so, in terms of silicon, power and performance, was kept very low. Thumb code would be around 65% of the size of 32-bit ARM code. Where 16-bit memory was being used, executing Thumb code would also be appreciably faster than comparable 32-bit ARM code.

This meant effectively having two instruction sets, with two encodings for many of the most frequently used instructions. Jaggar has described this as ‘about as un-RISC as you can possibly get’.

The addition of Thumb to the architecture wasn’t universally acclaimed. Sophie Wilson was still working at Acorn, working with ARM as a consultant, and objected strongly to the new approach. An ARM board meeting was convened, and with opinions split Steve Furber was brought back from Manchester University to give what was, in effect, a casting vote on Thumb. Furber gave it a qualified ‘thumbs up’ and the debate was settled.

TI and Nokia

So with Thumb now part of the architecture, Arm retained all the advantages of low cost, low-power and high performance whilst adding competitive code size. Thumb would be a vital tool in signing up the customer that would mark a decisive step forward.

As Saxby looked to sign up new licensees, Texas Instruments (TI) was an early target. They were a major SoC maker with a hugely successful Digital Signal Processor design but they had never been successful in designing microprocessors.

Inside TI views differed whether to adopt Arm. The Arm advocates in the TI team realised that it would only be a success for them if they could get end customers bought into using Arm. If they succeeded in convincing a major TI customer of the advantages of Arm, then the argument would be won.

So the TI team introduced Arm to Nokia. Teams from the three companies got together for an intensive workshop, in which Arm could present not only the latest ARM7 architecture but also Thumb.

With the Thumb extension to the architecture, Arm could now offer performance, low-power consumption, low-cost and competitive memory use. Nokia was won over and TI signed the Arm licence agreement in May 1993.

The first GSM phone to feature an ARM core was the Nokia 8110 released at the end of 1996, which used an ARM7 core incorporated on a TI SoC as its baseband processor. The 8110 was known as a ‘banana’ phone because of its banana-like shape and was used by Neo as his phone in the first Matrix film.

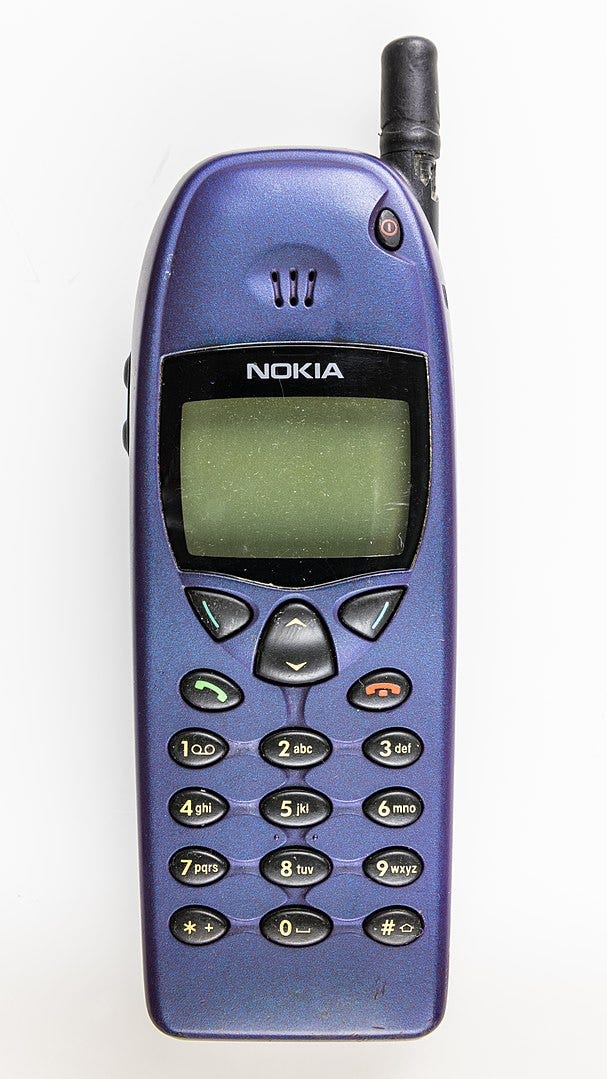

Next year, Nokia announced the 6110, which used an ARM7TDMI (T for Thumb, D for JTAG Debug, M for fast multiply and I for enhanced In-circuit-emulation) to power both baseband functionality (the part of the phone that converts the signal to data) and the user interface. The 6110 was a huge commercial success, selling over three million units in 1998. Its success made Nokia the leader in the cellphone market for the first time that year.

The path was set for processors used in mobile phones for over two decades.

With big name like TI and Nokia on board, perceptions of the company started to change. Saxby has said that until 1994 people thought “ARM hasn't got a hope…” and then from 1994 "Hmm, perhaps ARM might make it."

Samsung

And TI wasn’t the only ‘big name’ Arm signed up. Soon Saxby’s trips to Asia paid off again with interest from Korean giant Samsung. There was one problem, though. ARM didn’t have the cash or the people to support the work that Samsung wanted. So Saxby told Samsung what he wanted: $3m in cash to enable him to recruit the engineers he needed. In return, Samsung would pay a lower per chip royalty.

The cash duly arrived in 1994 and Saxby and his team set about recruiting new staff, doubling the number of engineers from 30 to 60. It was a move that later Saxby said almost broke the company, as staff needed to do their existing jobs whilst recruiting and training new staff at the same time.

By now, the ‘ARM barn’ was no longer big enough for the company, and they moved back into spare space now vacated by Acorn in their Cambridge offices.

Not all potential licensees bought into the Arm story. Motorola, where Saxby had worked previously, resisted. At one point, they offered to use ARM’s designs, but only if they could do so with a free licence and without paying royalties. Saxby, would later recall:

And we just kind of sat there with our jaw dropping. And, "Do you realize we're in business?" And so but he felt that because we would license it to Motorola, that that would be enough glory, that we wouldn't need to have any money.

Saxby pointed out that the fees for using Arm would be one quarter of their current processor engineering costs. Motorola held out, but a small stream of other licensees followed including NEC, Oki, Yamaha and Alcatel.

StrongARM

Members of the team at Digital Equipment Corporation (DEC) developing their Alpha microprocessor were looking for a way to reduce the power consumption of their design so that it could be used in mobile devices. After struggling with Alpha, they had a look at the ARM ISA and realised that they could create a high performance, low-power microprocessor by building a core using the ARM instruction set.

The obvious customers for such a device would be firms that were already selling hand-held devices to end users and who would be able to make use of a more powerful core. Who was already selling an Arm based hand-held? Apple with the Newton, of course.

So the DEC team approached Apple to see if they would be able to use such a design. According to Allen Baum of Apple, the reply was “Phhht, yeah. You can’t do it, but, yeah, if you could we’d use it.”

So DEC started working with Arm to develop their high performance core. It’s interesting to consider how such a development interacts with Arm’s business model. Arm made money by developing cores that used the ARM ISA and selling licences for firms to include those designs in their own System-on-Chips. What DEC was proposing to do was a radical departure from that model. A third party would design a core based on the ARM ISA, which would then be incorporated into their own SoC.

This new model would raise several challenges for Arm. If the new core was better than Arm’s own cores in some way, and the DEC core would be much faster, where would that leave Arm?

The fact that Apple was still a large shareholder in Arm at this stage may have had an influence on the outcome. Equally, if there was a risk of a competing ISA and low-power cores being developed by DEC, then that would pose a risk to Arm’s business. So, it would be better to allow DEC to use the Arm ISA under licence, expand the Arm ecosystem and keep Apple happy.

So StrongARM was born. The first microprocessor in the StrongARM line was the SA-110, which was announced in February 1996, and ran at up to 200 MHz, significantly faster than other ARM designs. The first design it was used in was the Newton MessagePad 2000.

The performance of the StrongARM designs meant that they were even used in Acorn’s desktop computer designs, such as the Acorn StrongARM Risc PC, which was launched in September 1996.

There would be a twist in the StrongARM story. DEC had sued Intel for patent infringement in Intel’s Pentium line of microprocessors. The two companies settled in October 1997 and as part of that settlement Intel bought DEC’s semiconductor division for $700m. StrongARM would take its place in Intel’s product line-up, replacing Intel’s own i860 and i960 RISC processors.

The sale of DEC’s processors wasn’t without controversy. Would Intel’s financial resources and expertise, combined with an ARM architecture licence, pose a threat to Arm? Saxby even had a phone call with Steve Jobs, who tried to persuade him to block the deal. In the end, Saxby persuaded Jobs that Arm would be fine, and the deal went ahead.

The license for DEC and then Intel to create their own ARM cores was the first of a series of similar licences granted to companies who wished to develop their own cores in house. Thus Arm was able to leverage the design skills of other firms and further expand the Arm ecosystem.

Floating the Arm Ark

Over this period, Apple was continuing to struggle and in 1997, Steve Jobs returned as interim CEO after Apple bought NEXT. Jobs soon rationalised the struggling company. The writing was on the wall for Newton when Jobs, asked at Apple’s WWDC developer conference, what he thought of Newton, described various versions as ‘junk’. He then went on an extended and prescient monologue about what he really wanted was a Newton with a keyboard and a wireless connection.

Soon afterwards, Newton was cancelled and Apple, for now, stopped being an Arm customer. Apple was still a large Arm shareholder though, and that shareholding would soon play a key role in Apple’s survival.

If ARM had been an ark for Arm’s founders looking to survive the flood of IBM PC compatibles that would wash away Acorn, then Arm’s flotation would be the ultimate vindication of the success of Saxby and the founder’s vision.

So in April 1998, Arm floated its shares on both the NASDAQ in the US and the London Stock Exchange in the UK. The shares were in high demand on the first day of trading, rising from £3.75 to £8.20 and leaving the company with a valuation of over $1 billion at the end of the week. Arm had only had profits of less than £5m, but was growing strongly.

This was a great outcome for both sets of shareholders. But the flotation soon created a problem for Acorn, as before long its value was less than the value of Arm shares that it retained. In other words, investors were placing a negative value on the residual Acorn business or, alternatively, were indicating that they much preferred to hold Arm shares directly rather than through Acorn.

It clearly made no sense for this to continue, but there was an obstacle. If Acorn sold the shares directly, it would incur a huge tax bill. A solution was found with investment bank Morgan Stanley buying Acorn and in the process swapping Arm shares for Acorn shares. The residual Acorn businesses were broken up and sold off bringing to an end a company that had briefly shone brightly during the home computer boom.

Apple was the remaining large shareholder in Arm and was having its own financial challenges. Over the course of 1999, Apple gradually sold its shareholding in Arm with the last shares being sold in 2000. In total, Apple raised over $1 billion from its Arm share sales, a vital source of funds when the company’s Mac business was struggling. Overall, it represented a giant return on Apple’s original investment. It wouldn’t be an exaggeration to say that the sale of Arm shares played a major part in saving Apple.

Conclusions

So at the end of the 20th century, ARM had achieved something remarkable. The Ark that twelve engineers had jumped to from a struggling Acorn had now floated. The business itself was thriving and looked to have secured a firm place in the market for embedded and low-power processors. Over 400 million ARM ISA processors shipped in the year 2000. Its customer list included many of the biggest names in semiconductors including TI and Samsung. Even Intel was now using ARM’s technology through its acquisition of the StrongARM business from DEC.

Perhaps most importantly though, Arm had found a place in Nokia’s, market-leading, GSM mobile phones.

Arm wasn’t yet the market leader in RISC processors, though. In 1997 Arm shipped only about one fifth of the number of cores of its RISC competitor MIPS. Hitachi, with its Super-H processor also had greater market share. There was looming competition from Motorola with their M-Core Micro RISC engine, which they described as an ‘ARM killer’.

Saxby had said at the start of his time at Arm that ‘We’re mere Davids against a lot of Goliaths but the little guys can still win if they’re sufficiently creative.’ By now it was clear, that even if they weren’t winning, then this David was at least holding its own against the Goliaths. Those Goliaths were still around though and just as much a threat as before.

If you’ve enjoyed this, then you will probably enjoy the supplement to this post which is available to paid subscribers of “The Chip Letter”. It’s got links to over two great books on Arm, over three hours of video with interviews with some key players in the ARM story, including Robin Saxby and Dave Jaggar, and lots of other materials on the early days of Advanced RISC Machines.

Image Credits

ARM 610 Die Shot

By Pauli Rautakorpi - Own work, CC BY 3.0, https://commons.wikimedia.org/w/index.php?curid=33594601

Nokia 6110

By © Raimond Spekking / CC BY-SA 4.0 (via Wikimedia Commons), CC BY-SA 4.0, https://commons.wikimedia.org/w/index.php?curid=69537981

DEC StrongARM

CC BY-SA 3.0, https://commons.wikimedia.org/w/index.php?curid=241552

Note that through this post I’ve tried to use Arm to refer to the company and ARM for the architecture. I may have erred on a few occasions though!

This was a great great series. I knew some of this ARM history, but this was well written and easy to understand.

Missing a word here... pivotal maybe?

Soon afterwards, Newton was cancelled and Apple, for now, stopped being an Arm customer. Apple was still a large Arm shareholder though, and that shareholding would soon in Apple’s survival.